Small Businesses Accountants

Based on their sector and business plan, we provide small businesses and new entrants with a comprehensive range of customised accounting and financial services. VVS consultants LTD go beyond simple number crunching. We manage growth and serve as company consultants. More is required for small businesses and start-ups than just cutting tax burdens and tightening budgets. To survive and expand healthily in the face of competition, they require a sound business plan and a long-term growth strategy. We give it to you directly.

Create an Independent Bank Account

To keep your income and prepare for taxes at year’s end by opening a business checking account and a savings account. your personal and company finances distinct, open a special bank account. You can better arrange

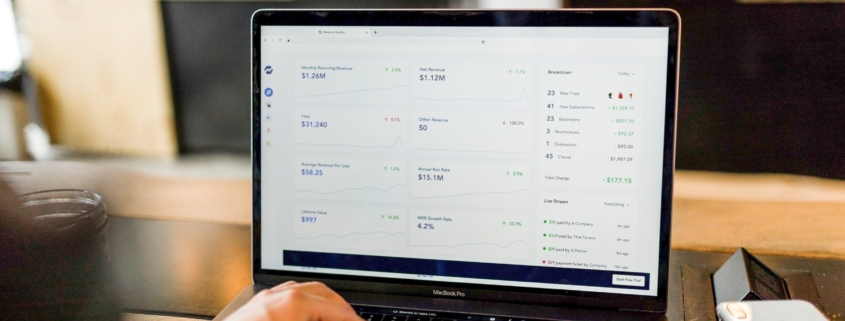

The financial statements should be produced.

Following the creation of the adjusted trial balance, you may now create the balance sheet, income statement, cash flow statement, and statement of retained earnings for your company.

Record all earnings and expenses.

A solid small business bookkeeping system is built on the ability to track and record business transactions. The source documents assist you in tracking the development of your company, preparing financial statements and tax returns, and keeping track of your deductible expenses (tax deductions). It’s crucial to remember that only costs directly related to the business should be documented. Invoices, cancelled checks, purchase orders, and other official business documents are some examples.